The world’s travel dreamers are poised to earn an extra five years on their Australia-opportunity clocks. I’m so proud of OZ for attempting to make and institute a government policy on a relevant timeline. The change hinges partly on reciprocity. Let’s hope other world-leading governments step up to the plate.

The Disease Behind The Symptoms

I have a theory about societal shifts being partly responsible for updates to the Australian Working Holiday programs. Here goes:

Secondary-education times are getting longer and longer. In the U.S. the term “fifth-year-senior” is now firmly part of the university-level lexicon. Across Europe (and globally at institutions modeled after Europe’s) changing your major resets your graduation clock to zero.

Add in the fact that rapid technology innovation now makes many future factors anyone’s guess, and you get a generation of post-millennials who have traded FOMO for FOFU – Fear of F*cking Up.

The downside to today’s lightning-fast technological progress? Making decisions about the future is no longer a vanilla-proposition. photo: anne-lise heinrichs

Today’s youngest adults languishing at universities have at least one thing in common with those immediately starting work: an uncertainty about how to prepare for a world that’s unknowable. As a result, they do what most sane citizens do: play it safe.

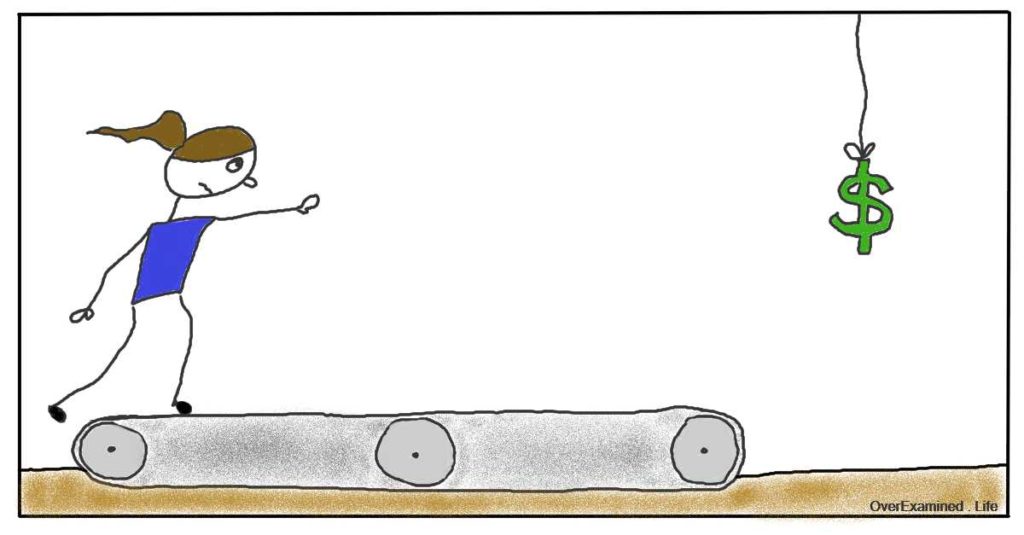

In this case, safe is following an obviously expired social script. Get job. Pay rent. Work job. Buy house. Work job. Pay mortgage. Work job. Degrade physically. Work job. Earn freedom.

photo: overexamined.life

While most post-millennials know and believe said script is unnecessary, a new precedent is still taking shape. Unfortunately for these freshly-minted adults, they have the difficult and uncomfortable job of designing the new model.

The Symptoms of the Disease

What does a snapshot of this in-progress precedent-setting look like? Here are my anecdotal observations made via travel forums I haunt, messages from Half the Clothes readers, etc.:

- For decades at least some young adults have always concluded mainstream life involves a lot of useless hoop-jumping.

- The number of young adults who feel like they’re jumping through hoops has grown.

- Because of the global uncertainties mentioned above, risk-tolerance has dropped.

- As a result, disenchanted youths are taking longer and longer to say “Screw this!”

- When they finally take off the training wheels and start to forge a new path, they discover business-hours are over for many appealing opportunities that have lower age limits.

Wait… you mean I’m finally ready to fulfill my lifelong dream of giving my job the finger and traveling the world… and I’m ineligible for one of the best options? photo: leonid mamchenkov

Australia’s Fix

The Land Down Undah is considering extending the age range for their working holiday programs to 35. Currently the range is 18-30. The change acknowledges the fact that many potential working holiday makers are getting a later start on their travels. (It may also acknowledge a labor shortage due not only to the increase in late bloomers, but also to the increase the Australian agricultural industry’s reputation for employee abuse.)

What is a working holiday? Australia doesn’t have the “unskilled labor pool” of Eastern Europe or Mexico at its doorstep 1neither does New Zealand – currently the only post-30 work-abroad option widely available, albeit accessible only through a costly placement company.. The island-continent addresses shortages for low-paid, manual laborers by inviting young people from pre-selected countries to experience a new culture while cashing up for future travels.

“Holla! Totes gonna go live in Asia for three years with all the cash I made picking cherries for Australians!” photo: taxcredits.net

While the marketing makes it seem like a win-win, in practice no one gets everything they want. It would be ideal for the Australian economy if working holiday makers contributed a cash infusion from their bank accounts back home and then, before departing, spent all the Australian dollars they earned onshore. It would be ideal for the “unskilled laborers” to have fair work environments and be able to do whatever the hell they want with the money they earn.

Assuming widening the age-range hints at a labor shortage, a backlash and therefore further labor loss seems possible if the government carries forward its plan to raise taxes for working holiday makers 2Recently, the government drafted a plan to start taxing backpackers at 32.5%. Previously anyone contributing labor to the Australian economy – both citizens and non-citizens – incurred a tax rate of 0% on their first $18,000 earned. Under the 32.5% tax plan, Australians would keep that privilege while backpackers would lose it. The outrage was so pronounced the government drafted a newer plan calling for the same set up – backpackers pay, Australians don’t – but this time lowering the tax to 19%. (Australians don’t pay 19% until they’ve earned $18,200.) Okay, so… sort of a win. Sort of. To try and make up the difference between a 19 and 32.5% tax rate, the OZ government tacked on a proposed new superannuation tax. Previously backpackers were forced to save 9.5% of their wages for superannuation (401K/retirement to Americans), and contributions were taxed at 15%. Then when travel-workers left OZ and took this money, it was taxed again at 38%. The new scheme calls for the same second-round tax to be raised to 95%. Not a typo. That’s right – backpacking workers are required to contribute 9.5% to retirement. Then when they withdraw that money (because they aren’t actually allowed to retire in Australia and won’t be a drain on the Australian economy if they fail to save for retirement), Australia is going to go ahead and keep 95% of what they were forced to save. Say what? By my calculations, 95% superannuation tax plus 19% wage tax works out to nearly a 30% tax rate on a typically poor population. without expanding the labor pool to include 31-35 year olds. You can’t blame a country for wanting to have its cake and eat it too. I just hope Australia realizes its program’s fan base has shrunk – and takes age-range increasing action – so labor shortages don’t cause domestic costs to grow.

Although I’ve already used my eligibility for both an Australian Working Holiday and a New Zealand Working Holiday, my fingers are crossed for all the early-30s folks out there to whom a window may soon open.

Happy Travels! ♣

References

| ↑1 | neither does New Zealand – currently the only post-30 work-abroad option widely available, albeit accessible only through a costly placement company. |

|---|---|

| ↑2 | Recently, the government drafted a plan to start taxing backpackers at 32.5%. Previously anyone contributing labor to the Australian economy – both citizens and non-citizens – incurred a tax rate of 0% on their first $18,000 earned. Under the 32.5% tax plan, Australians would keep that privilege while backpackers would lose it. The outrage was so pronounced the government drafted a newer plan calling for the same set up – backpackers pay, Australians don’t – but this time lowering the tax to 19%. (Australians don’t pay 19% until they’ve earned $18,200.) Okay, so… sort of a win. Sort of. To try and make up the difference between a 19 and 32.5% tax rate, the OZ government tacked on a proposed new superannuation tax. Previously backpackers were forced to save 9.5% of their wages for superannuation (401K/retirement to Americans), and contributions were taxed at 15%. Then when travel-workers left OZ and took this money, it was taxed again at 38%. The new scheme calls for the same second-round tax to be raised to 95%. Not a typo. That’s right – backpacking workers are required to contribute 9.5% to retirement. Then when they withdraw that money (because they aren’t actually allowed to retire in Australia and won’t be a drain on the Australian economy if they fail to save for retirement), Australia is going to go ahead and keep 95% of what they were forced to save. Say what? By my calculations, 95% superannuation tax plus 19% wage tax works out to nearly a 30% tax rate on a typically poor population. |

Twitter Facebook Google+ StumbleUpon Reddit Pinterest